Explore

Retirement Savings Options: Navigating the Path to a Secure Future

Planning for retirement is one of the most critical financial decisions individuals face. With the increasing life expectancy and rising cost of…

Continue Reading Retirement Savings Options: Navigating the Path to a Secure Future

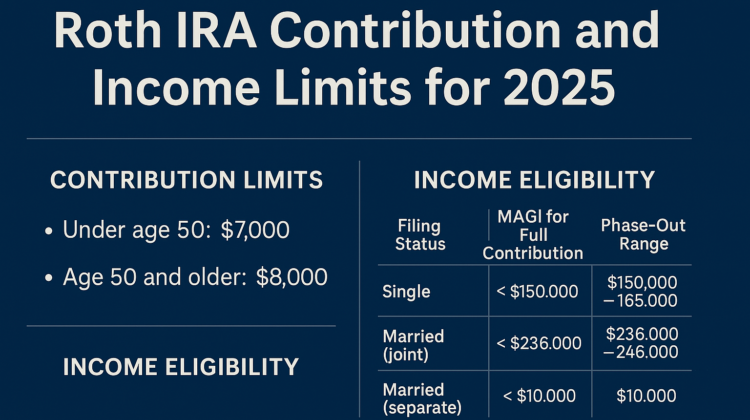

Retirement Planning

Retirement planning

IRA and 401(k): Compare Your Retirement Options

When planning for retirement, understanding the different investment options available is crucial. Two popular choices are the Individual Retirement Account (IRA) and…

Continue Reading IRA and 401(k): Compare Your Retirement Options